SSS Monthly Contribution Table & Schedule of Payments 2024

What is the SSS contribution table all about?

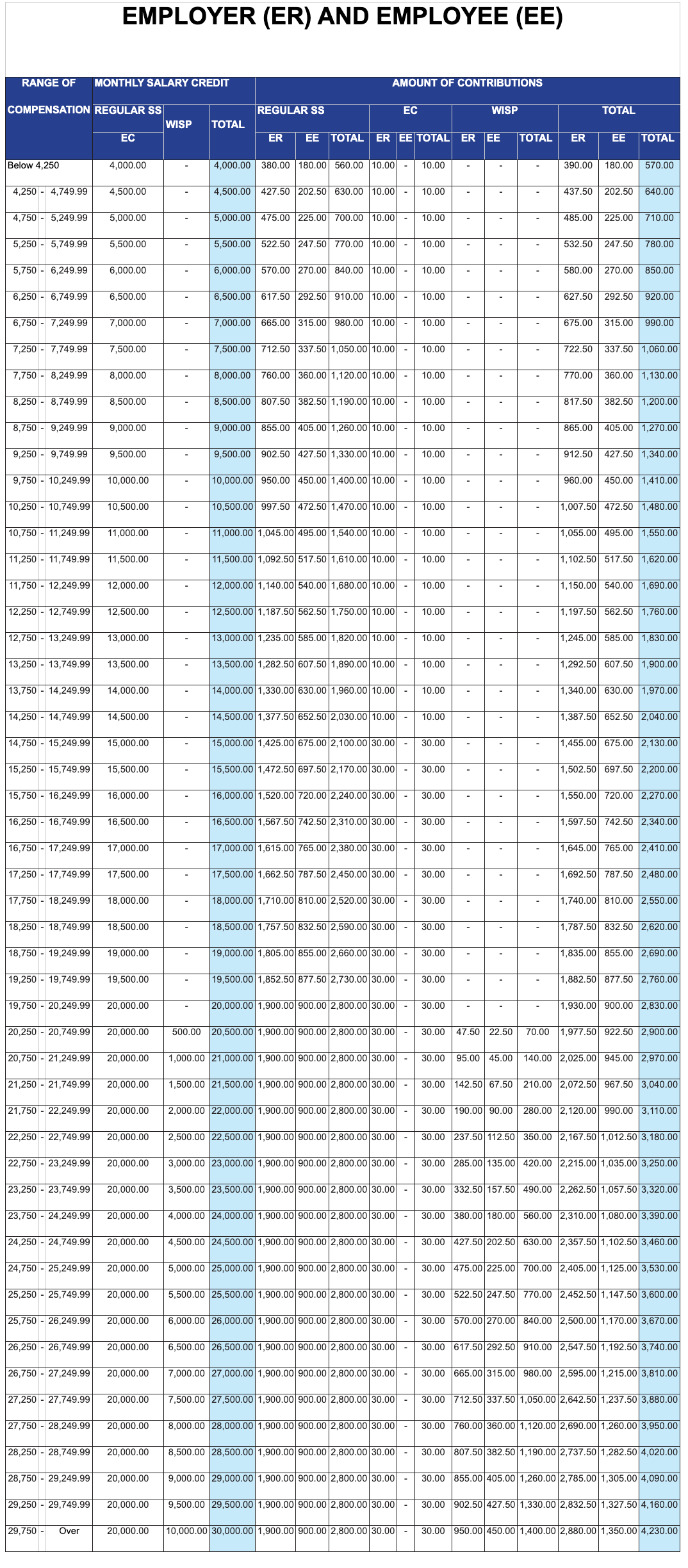

The Social Security System officially publishes an SSS contribution table and schedule of payments so SSS members know the specific amount they need to pay per month according to their monthly salary (or compensation). To avoid deficit or any errors in the payment, SSS strongly advises its members (self-employed, voluntary, household members, and domestic helpers) to regularly check the contribution table and the new amounts (if there’s an update) they need to pay. Note that the 2024 SSS contribution table includes the mandatory provident fund for members (for the Worker’s Investment and Savings Program).SSS Contribution Table for Employed Members and Employers in 2024

You will find below the SSS contribution table for employed members and employees, including the share of employee and employee for the total contribution.

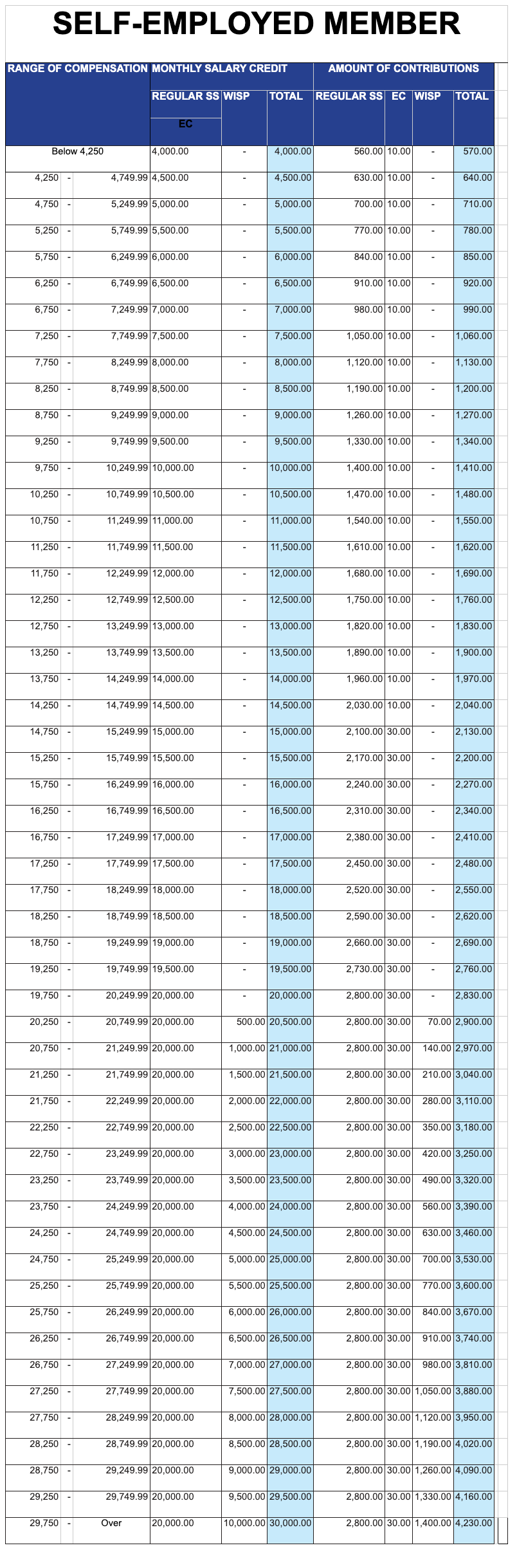

SSS Contributions Table for Self-Employed Members in 2024

The table below is for freelancers or self-employed professionals. As you can see, those who belong to this category with a 20,000 monthly salary credit need to pay the mandatory provident fund.

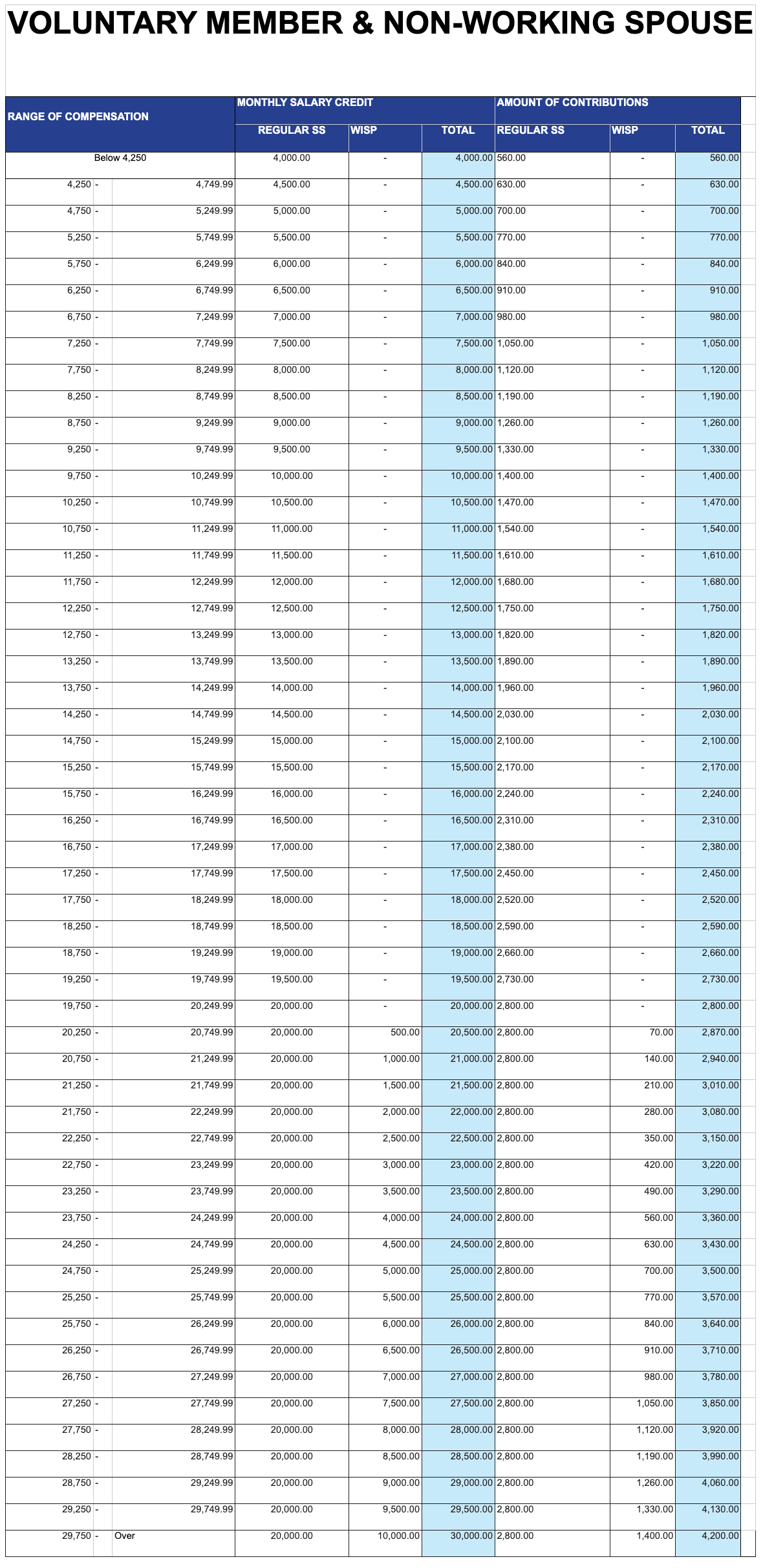

SSS Contributions Table for Voluntary Members and Non-working Spouses in 2024

The table below is for voluntary members (could be unemployed) and non-working spouses who want to retain or resume their SSS membership. Note that for this category, the minimum monthly salary credit is 3,000 pesos. In addition, for non-working spouses, the contribution will be based on half (50%) of the monthly salary credit of his or her working spouse.

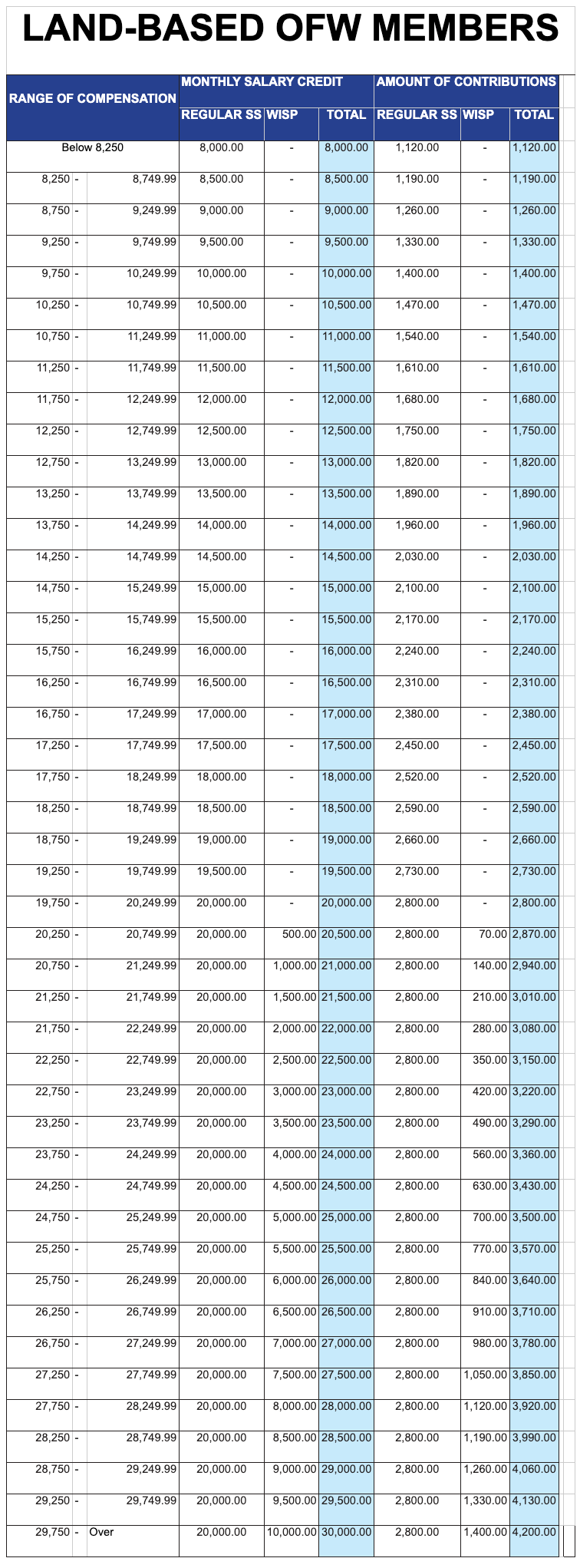

SSS Contributions Table for Overseas Filipino Works (OFW) in 2024

If you’re an OFW, you will notice in the table below that the monthly salary credit starts at 8,000 pesos, the highest in all categories.

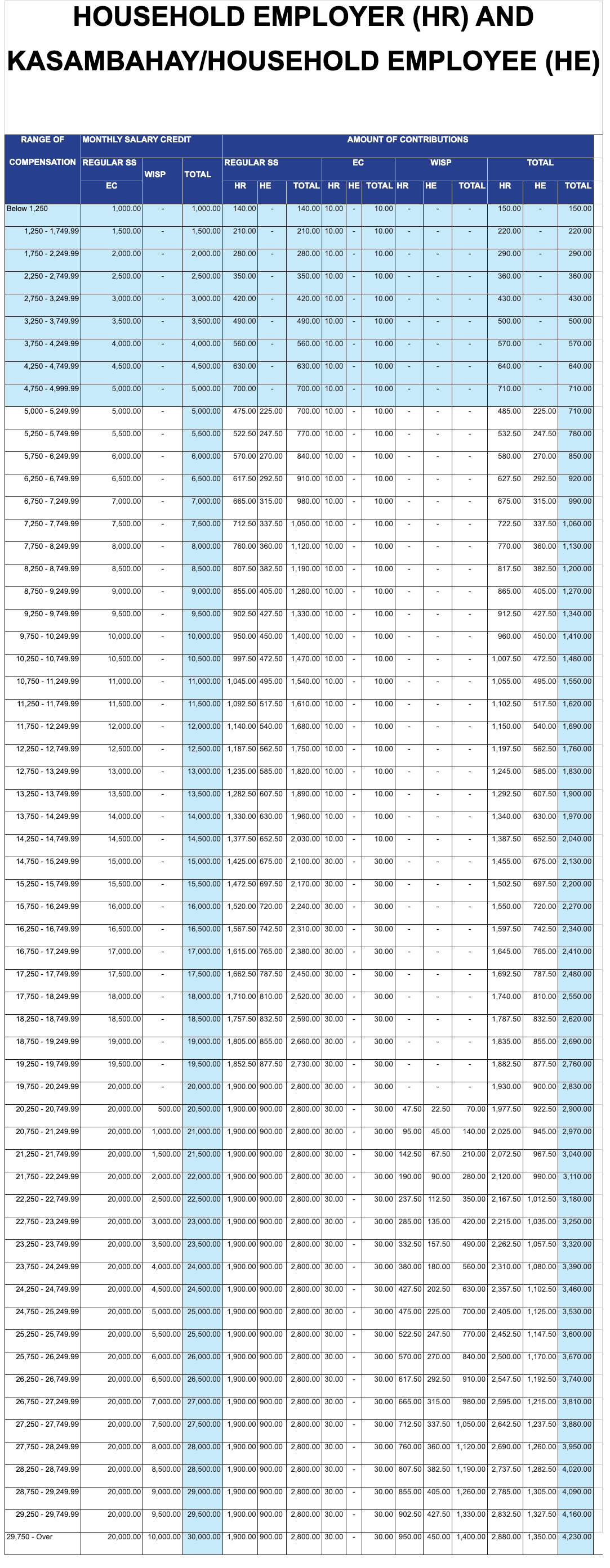

SSS Contributions Table for Household Employers and Domestic Helpers in 2024

The table below is for domestic helpers and their employers in the Philippines. Note that for domestic helpers who earn less than 5,000 pesos per month, the household employer should pay the full SSS contribution amount (according to Republic Act 10361, otherwise known as the Domestic Workers Act).

Common Questions on the SSS Monthly Contribution in 2024

Here are some questions you might be asking regarding the SSS monthly contribution in 2024:1. What is the difference between the new and the old contribution rates?

The main difference between the old and new contribution rates is that the new contribution rates aim to give SSS members more benefits (pension payments) in the future. This is why if you compare the old and new contribution rates, you will notice that the new ones cover more of the member’s monthly incomes. For the old rate, the employee/employer contribution is: 4% employee share + 8% employer share = 12% total For the new rate, the employee/employer contribution is: 4.5% employee share + 8.5% employer share = 13% total In addition, the minimum and maximum monthly salary credit also changed. The old monthly salary credit ranges from 2,000 to 20,000 pesos while the new one ranges from 3,000 to 25,000 pesos.2. How to get your SSS Payment Reference Number (PRN) for the contributions

You need the PRN to pay your SSS monthly contributions as most payment outlets like banks, bayad centers, and SSS offices require you to have one. There are three basic ways to get your SSS Payment Reference Number:- Through the SSS website

- Through text

- Through email

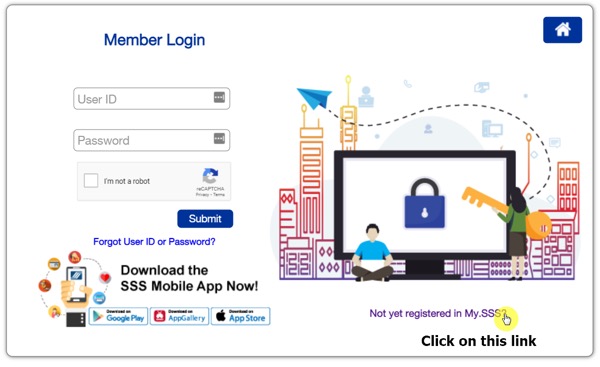

For the website method, you need to register to the My.SSS program to get the SSS Payment Reference Number. Visit the website link below to get started: https://member.sss.gov.ph/members/ Once here, click on the “Not yet registered in My.SSS?” link in the lower-right corner of the box:

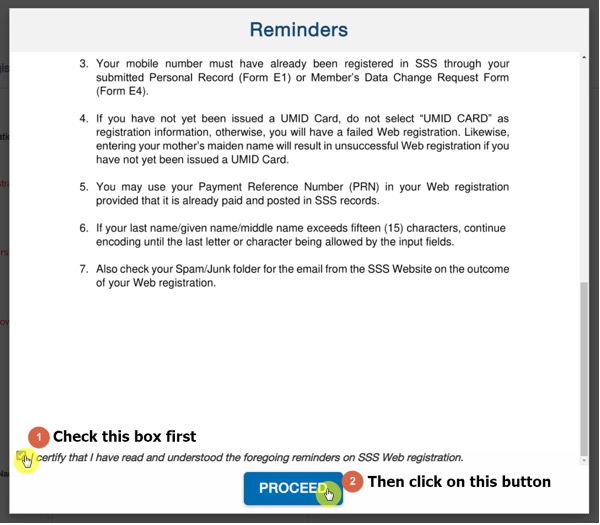

Read the reminders on the box. Once you’re done, check the certification box below and click on the “PROCEED” button.

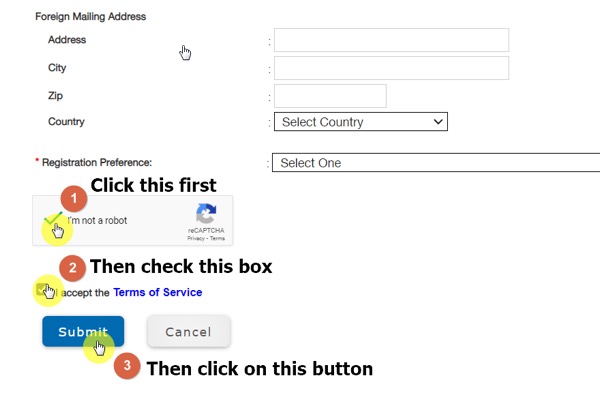

Fill out the form. When you’re done, deal with the captcha form first. Then, accept the terms of service and click on the “Submit” button.

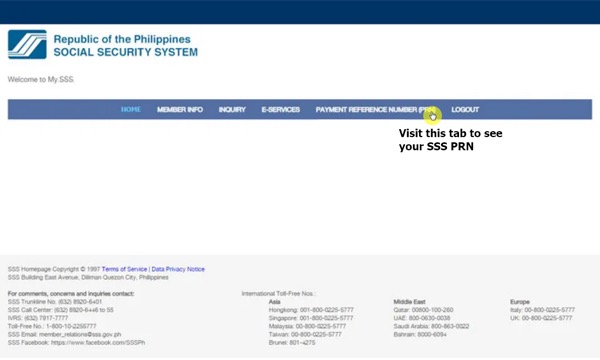

After that, you should see this tab. This is where you will find your payment reference number according to the month you need to pay.

Note that if you want to check our SSS contribution online, go to the “Member Info” tab. If you want to use the text method, simply send the following message to 2600 (regular text charges apply): SSS PRN <10-digit SS number> <PIN> <Date of Birth> For email inquiries, you can request your SSS PRN from this address: prnhelpline@sss.gov.ph

3. How much is your monthly SSS contribution?

This depends on whether you’re employed, self-employed, a voluntary member, etc. Check the SSS contribution tables below according to the category you belong in as well as the correct income bracket.4. Can you increase your SSS contribution?

Yes, you can if your monthly salary has also increased (which your employer, if you’re employed, should automatically do once you’re given a raise). Your payments will follow the salary bracket and the category you belong to. Don’t forget to pay your SSS contributions on time. Make sure to rely on the contribution table to avoid errors (paying less or more than you should) when making your contributions to SSS. By the way, if you’re an employer, are you looking to expand your business online? Set up with z.com now and get high-quality web hosting with a free domain and free SSL for only 1,176 pesos for a year.PROMO

FREE Web Hosting

for Your Website