Everything You Need To Know About GCash

Keep and transfer funds | |

Online or offline purchase | |

Pay utilities/bills | |

Benefits of a GCash Account | Buy load |

Withdraw funds | |

Access to a good credit line | |

Platform loans | |

Buy cryptocurrency | |

GCredit | |

Benefits of Having Good GScore | GLoan |

GGives | |

Use GCash consistently | |

Pay, Invest, and Save on GCash | |

How to Get Good GScore | Frequently update your GCash app |

Schedule significant payments on non-salary weeks | |

Pay your GCredit bills on time | |

GCash Mastercard | |

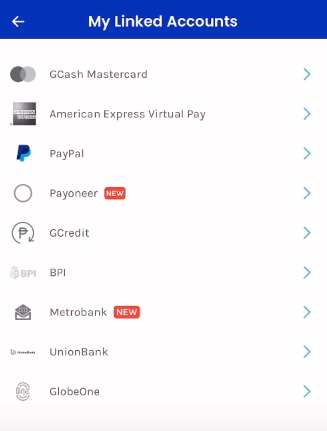

Bank Account Linking | |

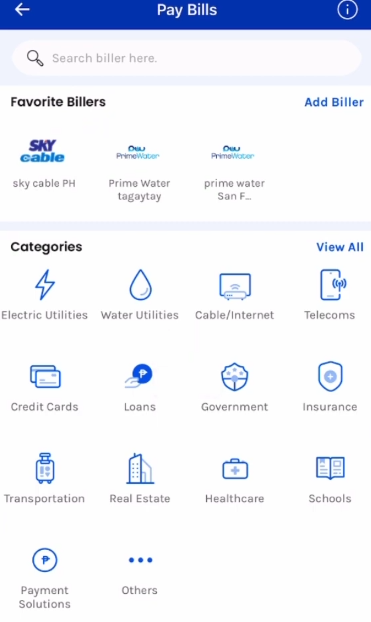

Additional GCash Features You Should Know About | Remember Billers |

Biometric Authentications | |

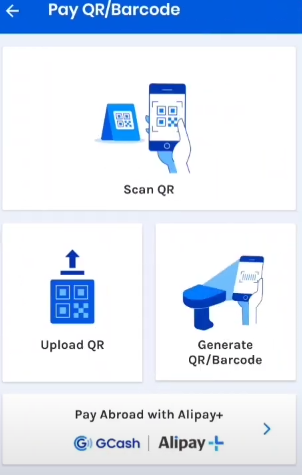

Pay QR |

GCASH FEES |

Cash-in Fees |

Through bank via mobile or online banking | Varies (free – P50) |

From linked back accounts | Free |

Through Remittance partners | Free |

Over-the-counter outlets, below monthly PHP 8000 limit | Free |

Over-the-counter outlets, above monthly PHP 8000 limit | 2% of amount |

GCash is one of the most popular financial apps in the Philippines. Almost every smartphone in the country has a GCash account, and the number keeps growing.

But just what’s so great about this digital wallet anyway?

In this article, we will go over the details of the entire GCash app experience, from creating an account to evaluating the bad points of the app.

Ready? Let’s dive right in!

What is GCash?

GCash is a digital wallet that can perform most financial services available to a basic bank account. This platform lets you have all the basic functionalities necessary in the modern world: it enables you to keep money, transfer money, buy load, and even pay various bills.

The real treat comes to those who can meet the app’s qualifications. Members with good standing also get access to more in-depth functions, such as:

· Moving significant amounts at once

· Getting a credit limit for purchases

· Opting to pay in installments

A true do-it-all, GCash is bristling with features waiting for its users to discover.

Interested yet? In the next sections, we’ll discuss in detail the different features you can use from the GCash app and every part of the platform’s user experience.

How to Create a GCash Account

Before we can evaluate the capabilities of the GCash app, let’s first discover how easy it is to make a GCash account.

After all, everything begins with the account creation – you can’t use any of its features unless you have a verified account.

Here are the different ways that you can go through to make an account on this platform.

Step 1. Account Creation

Although you can only use GCash in the actual GCash app, there are several ways that you can create an account on this platform: through the website, through USSD (*143#), and through the GCash app.

Let’s go through each one.

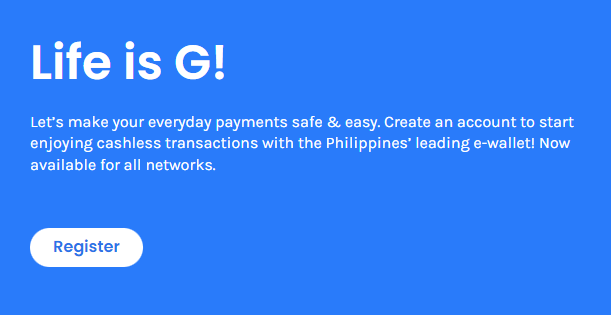

Account Creation Through the GCash Website

You don’t have to install anything to create an account on GCash using your desktop. If you register through the desktop website, you can even benefit from a big screen with full access to your laptop or desktop keyboard.

Here are the steps you can follow to create a GCash account through the GCash website.

1. On your browser’s search bar, enter the GCash URL.

2. One of the first things you should see on the screen is the GCash tagline with the Register button right under it. Tap this button to proceed with the account creation.

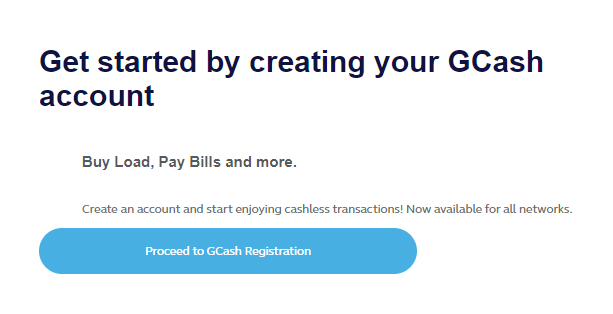

3. Confirm that you want to register for a GCash account to continue.

4. The following window will show you the initial stages of the GCash account registration. entering your mobile number. When finished, just click Next.

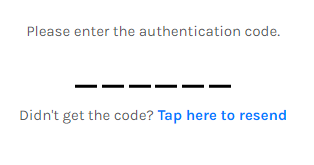

5. A code will be sent to your number for confirmation. Enter it to proceed.

6. You will then repeat the process, entering additional details such as your personal information, Mobile PIN (MPIN), and more.

7. Congratulations! You now have a GCash account that you can open from the GCash app.

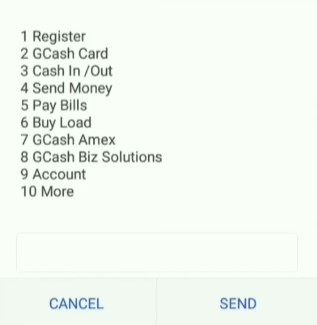

Account Creation Through USSD (*143#)

You can also create a GCash account without having to open a website or download the app. If you urgently need to create an account but don’t have access to mobile data or a computer, don’t worry – you can make an account just by dialing a number on your phone.

Here’s how.

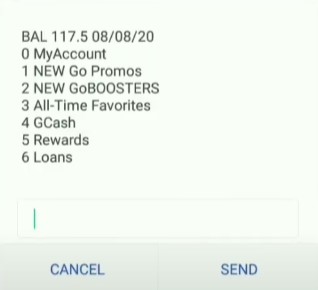

1. On your phone’s home or phone app, dial the number *143#.

2. This is a USSD code that brings up the menu of Globe, the company that co-handles Gcash. Click Reply and type the number for Gcash.

3. A new menu will show up. Type 1 to register for an account.

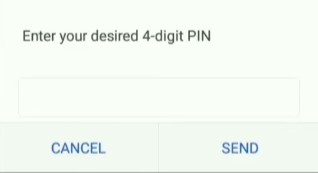

4. Follow the next instructions. You’ll be asked to provide your preferred MPIN, as well as necessary personal information such as your name, birth year, etc.

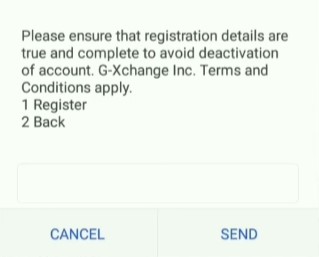

5. You’ll be asked to confirm your registration and accept the Terms and Conditions. Tap 1 to continue.

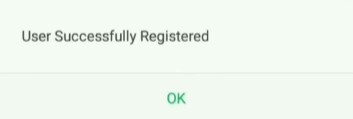

6. Now you have a registered Gcash account! You can log in to the app the next chance you get with the details you typed in the USSD code.

It’s important to note that although this method is accessible even if you don’t have mobile data or text credits, it’s not as user-friendly or convenient as the other methods.

Account Creation Through Mobile App

Perhaps the easiest and most convenient way of creating an account in GCash is through the mobile app.

It’s the most popular method, as well. That’s because you get a more seamless registration experience if you do it through the mobile app.

Here’s how you can do it.

1. The first step is to download the mobile app on your smartphone. You can do this by going to your mobile device’s Play Store or App Store.

2. Search for GCash, and then download and install it.

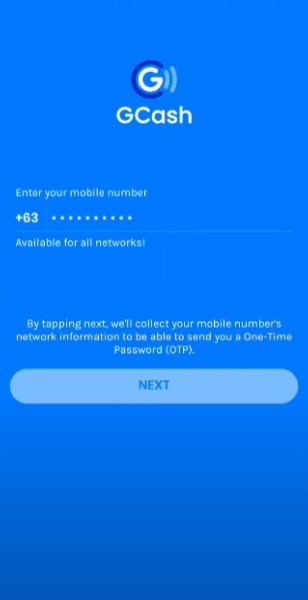

3. When you open the app, Google will first ask you to provide your mobile number.

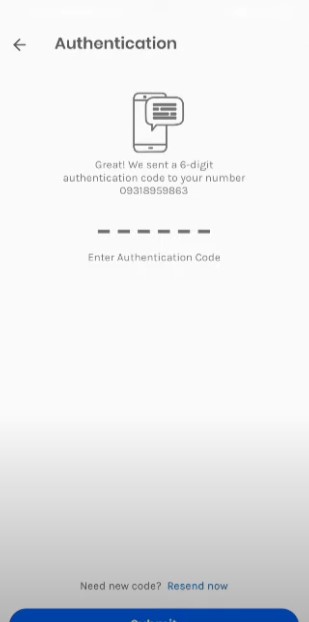

4. An OTP will be sent to your number in order to verify it. Type the OTP in the app to continue.

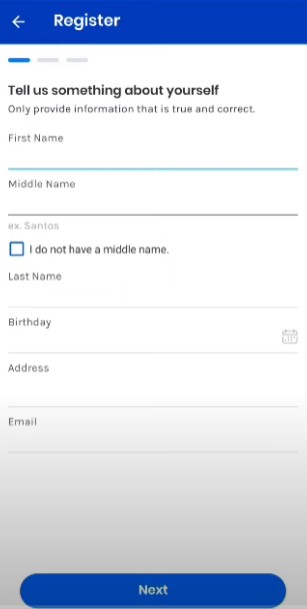

5. Next, you need to provide your details, such as an address, age, and more.

6. You also have to choose your preferred MPIN, which you will use to log in to your GCash account every time.

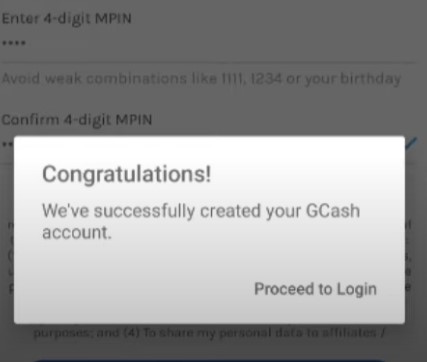

7. Congratulations! You now have an active GCash account. You can tap Login right after to go straight to GCash.

Step 2: Verifying Your Account

Verifying your account is crucial if you want to enjoy all the benefits that GCash offers.

This step is necessary because the platform needs to be sure that you are who you say you are. After all, GCash deals primarily with money, so it’s only natural that they would want to avoid fraudulent individuals.

Here are the steps for verifying your account:

1. Open the GCash app and log in with your MPIN.

2. You’ll see several buttons labeled home, inbox, pay QR, activity, and profile. From these choices, pick Profile.

3. The next screens should display your name, number, and other options. Right below your name, click the Get Fully Verified button.

4. Next, take a picture of your valid ID.

5. You will be asked to take a selfie for further verification in the next window. Ensure that the quality is clear and that there are no distracting backgrounds behind you.

6. You will then be asked to fill various fields for other personal details.

7. Accept the Terms and Conditions by ticking the box, then click Confirm.

8. If everything goes well, you only have to wait 30 minutes to an hour for your verification request to be reviewed.

Congratulations, now you have a fully verified account!

You can choose not to verify your account if you want, but verified accounts present way more functionality than just a registered account. In the first place, you won’t be able to appreciate all the app’s features without verification as there will be limitations for everything.

Step 3: Loading Your Account

Lastly, after registering and verifying your account, you need to add “load” to your account. Loading simply means topping up your money in the app with digital cash.

There are various ways that you can top up your GCash account. One way is to go to physical locations like the 7/11 convenience store and deposit money. However, the most convenient way is to cash in from a bank account or another financial app.

Regardless of which one you choose, here are the steps for adding money to your Gcash account.

1. Log in to your GCash app.

2. Tap the button with the phone icon. This is the button for Cash-in.

3. Choose the method most applicable to your situation: whether using physical money delivered over the counter or through online banks.

4. Once you’ve selected the cash-in method, you will be shown complete instructions on how to accomplish the transaction. Simply follow all the steps to proceed.

Physical transactions will require you to either use a kiosk or talk to the cashier behind the counter. A QR code will be generated, which you will then scan with your mobile app. After that, simply pay the appropriate amount, including the transaction fees. The amount you topped up should be immediately reflected on your account.

If you’re transferring from an online account, app, or wallet, you just have to provide your details and save them to your GCash app. You will then be able to top up anytime you wish.

What Can You Do With a GCash Account?

As a digital wallet, GCash works very similarly to other financial apps. It does have plenty of features though, which we’ll discuss below. Again, if you’re a fully verified user, you’ll be able to access all of these.

· Keep and transfer funds. You can use GCash to store and move money from your account to other digital accounts.

· Online or offline purchase. You can pay with GCash if you’re buying something in most malls, and almost all major online stores accept GCash as a mode of payment.

· Pay utilities/bills. GCash is growing the number of billers that they cater to. You can pay for government services, utilities, internet, insurance, and other utilities through the GCash app.

· Buy load. One of the essential features of GCash is to buy load for your or another’s mobile number.

· Withdraw funds. GCash also lets you withdraw your funds through a convenient debit card or through accessible partners that will give you your money over the counter.

· Access to a good credit line. GCash has a “Buy Now, Pay Later” and installment payment option through G Gives, which users that reach specific trust scores can use.

· Platform loans. GCash also offers loans to users that qualify based on their trust scores.

· Buy cryptocurrency. Cryptocurrencies can be helpful for various situations, and you can buy them through your GCash balance.

As you can see, there are many uses you can get out of a fully verified GCash account, although some of the functionalities mentioned are only for those who qualify.

GCash has a system in place to judge your creditworthiness – or how much they should trust you, based on your previous transactions. The following section will talk about the GCash credit scoring system.

The Score and GCredit System

A credit card is a beneficial modern convenience that you can use for all aspects of your life.

Whether you’re buying groceries or applying for installment payments for big purchases, a credit card is a very convenient way to use money.

However, many Filipinos are unable to get a credit card. This is the gap that GCash is trying to fill with the GScore system.

As such, the GScore system is a way to give a credit score to individual users.

This is the GCash’s version of a credit score, which is a number that stands for your financial trustworthiness.

In the US, this is called the FICO system. The credit score records your qualifying transactions, including good and bad financial behavior. Banks and other financial institutions in the US use this centralized credit scoring system to judge an individual’s risk factor. This means that your credit score can affect your mortgage, bank loan rates, and more.

In the absence of a centralized credit score in the Philippines, GCash has created a system that works like the US FICO scoring, called the GScore.

People who use GCash can increase their GScore rating by using the app frequently. High-quality transactions such as investing, paying bills, linking bank accounts, and more will improve your GScore. On the other hand, not using the app and leaving it with a low balance can make your score go down.

What Can You Do With GScore?

A credit system is good and all, but what can you do with GCash once you get a high enough score? Here are some features you can unlock once you get a high-enough GScore.

GCredit

The main benefit of GScore is that it makes you eligible for GCredit.

GCredit allows you to pay for purchases and bills with a credit limit to be paid later. It’s essentially a credit line designed exclusively for the GCash ecosystem.

You will be charged a 5% monthly interest rate, which is slightly higher than most credit cards at 3%.

However, it can still be cheaper since it computes your interest daily instead of monthly. This means that if you pay your dues ahead of time, it’s actually cheaper to use than traditional credit cards.

GLoan

If you get a high enough credit score, you will be eligible to take a loan from GCash. These loans have minimal fees and can be taken out of the GCash ecosystem for whatever use you have. The exact terms will depend on your GScore, though.

GGives

With GGives, you can buy big purchases and pay them later. You will also be able to split up the payment into more manageable chunks.

GGives lets you pay big purchases in installments. You can choose between three, six, nine, and twelve-month increments with varying loan terms. The terms for each GGives purchase will also vary based on your GScore at the time.

Increasing Your GScore

When it comes to earning GScore points, both quality and quantity are needed.

The main principle is that: the more you use GCash, the higher your GCash score can become. However, GCash also assigns “value” to your transactions. Simply cashing money in and buying load daily doesn’t increase your score.

High-quality GCash transactions are essential if you want to improve your credit score. These transactions show that you’re a person with good financial habits and can become a good investment.

Here are some tips and tricks that you can use to increase your GScore.

· Use GCash consistently. Simply put, use GCash as often as you can. Buying load, receiving and sending money, paying online – these don’t amount to much individually, but they can add up to create a good score overall.

· Pay, Invest, and Save on GCash. Use lesser-known features that prove you’re a good borrower. Invest in GCash’s mutual funds, save on their high-interest savings account, and pay with a QR code.

· Frequently update your GCash app. GCash might implement changes to how your GCash app is run, so ensure that your app is always up to date.

· Schedule significant payments on non-salary weeks. GCash refreshes your credit numbers every week. To give an appearance of consistent use, schedule significant expenses (bills, invest) on the weeks when you don’t cash in large amounts of money to your account.

· Pay your GCredit bills on time. If you’ve already activated your GCredit, ensure that you don’t incur additional fees and take a hit on your credit score by always paying your bills on time.

Earning GScore might be painstaking, but the convenience that a high GScore can give you is unparalleled.

The Various GCash Fees

Like other digital wallets, GCash also incurs fees for various transactions that you do on the platform. This section will comprehensively list all of the fees that you will encounter on the GCash app and how much you will pay for them.

There are multiple fees that you will need to pay on the GCash app, such as: cash in, cash out, send money, bills payment, GCredit, and MasterCard Account.

Cash-in Fees

Through bank via mobile or online banking | Varies (free – P50) |

From linked back accounts | Free |

Through Remittance partners | Free |

Over-the-counter outlets, below monthly PHP 8000 limit | Free |

Over-the-counter outlets, above monthly PHP 8000 limit | 2% of amount |

Bank Cash-in Fees

BPI to GCash | P25 |

BDO to GCash | P25 |

Everything else | Free |

Cash-Out Fees

Through over-the-counter partners | 2% of amount |

ATM withdrawal | ₱20 |

ATM withdrawal outside the Philippines | ₱150 |

Send Money Fees

Express Send | Free |

Express Send With Clip | Free |

Ang Pao | Free |

Bank Transfer | P15 |

KKB/Request Money | Free |

Bills Payment Fees

Fixed fee billers | Free to ₱60 |

Percentage-based fee billers | 2% of amount |

GCredit Fees

Interest fee paid within your stated billing period | 3% to 5% |

Penalty fees 1-30 days after stated due date | P200 |

Penalty fees 31-60 days after stated due date | P500 |

Penalty fees 61-90 days after stated due date | P900 |

Penalty fees 90 days or more after stated due date | P1,500 |

MasterCard Account Fees

Balance inquiry thru ATM | P3 |

Via ATM outside Philippines | P50 |

Dormancy fee | P50 |

GCash MasterCard request offline requesting fee | P150 |

GCash MasterCard request online requesting + delivery fee | P215 |

Additional GCash Features You Should Know About

GCash is a powerful financial tool that fills an inevitable void for many Filipinos. Nevertheless, not many truly know just how convenient GCash can be. In no particular order, here are some incredibly useful features GCash has that not many people know about.

GCash Mastercard

GCash has a physical card that lets you withdraw your GCash balance from any ATM, making cashing out much more efficient and convenient.

Any GCash user can request a GCash MasterCard for a small fee. Instead of going to a partner store, lining up, and processing your cash transfer, you can go straight to any ATM and withdraw money just like how you would like any bank.

Plus, since it works like a regular debit or credit card, you can even use the GCash MasterCard for online purchases.

Bank Account Linking

Linking your accounts is way more convenient if you frequently transfer money from your GCash account to your bank accounts.

It also gives some benefits. First, you won’t have to enter your details every time, which is excellent since not many people have their bank account numbers memorized.

The second benefit is lesser-known but is just as appealing: linking your bank account gives you a small incentive on your credit score.

Remember Billers

GCash now serves almost every major biller in the Philippines. Government agencies, utility companies, the internet, and even insurance are present in the GCash ecosystem, and you can quickly pay your bills.

However, inputting your billers’ details every time you make a payment can quickly become a chore.

But don’t worry – you can save all your billers in GCash, to avoid doing this process over and over again.

Repetitive information such as your account numbers, transaction amount, etc., can be saved to your GCash account, so you just have to tap a few things to pay your bills.

Biometric Authentication

Instead of inputting your MPIN every time you log in to GCash, you can instead enable biometric authentication.

The GCash app now supports fingerprint and face ID login. This is more convenient (compared to the MPIN and OTP combo that most users have), but it’s also more secure since logging in will be exclusively tied to unique biological markers for every person.

This means there’s less likelihood of your GCash being hacked by scammers since they’ll have to physically access your phone and your body to get into your account.

Pay QR

With GCash’s pay QR feature, buyers and sellers can transact better in the real world.

Instead of carrying around cash all the time, users can just have a balance in their GCash account. All they have to do is scan a QR code to pay for their purchases in the mall, grocery, or small business.

This benefits both buying and selling parties since it eliminates hassle, minimizes errors, and makes transactions more secure.

FAQ

Do I need a bank account for GCash?

No, you don’t need a bank account to open a GCash account. However, if you do have a bank account, you can link it to your GCash account for more accessible and more secure transactions between them,

Is there a minimum balance for GCash?

No, you don’t need a minimum amount of money in your GCash account to continue to transact. Having zero balance in your GCash account is acceptable, although it might lower your GScore.

If you’re not aiming for a high GScore, there’s no demerit to having zero balance in your account.

What is the maximum wallet limit for Gcash per month?

Unverified users have a max wallet limit of PHP 50,000, while verified users have PHP 100,000. If you link your bank account to GCash or register for a business account, you will enjoy a PHP 500,000 maximum wallet size.

Is there a fee to cash in or cash out?

Yes, specific methods incur fees when cashing in or out in GCash. These fees vary depending on the technique and partner used in the transaction, although GCash to GCash and Bank Account to GCash transactions are generally free.

Is GCash safe?

Yes, GCash is safe. Millions of Filipinos use GCash every day, and so far, there have been no significant hacks on the network.

Additionally, GCash is continuously strengthening its security measures by adopting new and better technologies. The only real threat is scammers, which information drives and technology education can solve.

Conclusion

With its mission of serving the underbanked Filipino masses, GCash has created an entire ecosystem that fills a huge gap.

Now, everyday Filipinos can receive and transfer money, buy load, pay bills, buy things, and more – all without having to undergo the lengthy process of opening a bank account. But GCash is more than a simple digital wallet; it has compelling features ready for those willing to get to know the app.

This article discussed everything you need to know about GCash: how to open, verify, and fund an account, the GScore system, and other lesser-known app features. With this, you now have everything you need to enjoy GCash!

PROMO

FREE Web Hosting

for Your Website