Online, Mobile, and Digital Banks Comparison in the Philippines: A Definitive Guide

Each of these methods has its own advantages and disadvantages, so it is important to understand the differences between them before deciding which one is right for you

Differences Between Online, Mobile, and Digital Banking

By understanding the differences between these three types of banking services, you can make an informed decision about which one best suits your needs.

The following is a summary table of the differences between online, mobile, and digital banking.

Online Banking | Mobile Banking | Digital Banking | |

What is it? | All banking transactions are made through the bank’s secure website via a computer or laptop | A mobile service that enables users of an existing bank to do transactions using their mobile devices | Digitization of traditional banking services, procedures, and operations to better serve customers online |

Which device would you use? | Over the internet, most commonly via the computer or laptop | On the mobile, i.e. smartphone Internet banking | On computers, phones, and other smart devices |

How many banking functions are offered? | More comprehensive features and functions when compared to mobile banking | Limited number of features and functions | Most adaptable banking system with the most features, which enables them to develop and add features considerably more quickly |

What do you need to connect? | Only requires a browser and an internet connection to connect to your bank’s website | Requires a banking application, SMS services, or mobile banking website | Requires a banking application, SMS services, or banking website |

How are you likely to access your account? | Needs internet access, generally via Wi-Fi or a wired connection | Needs internet access, typically via Wi-Fi or data connection | Needs internet access, either via Wi-Fi, wired connection, or a data connection |

What is Online Banking?

Online banking refers to financial transactions that are conducted via the Internet.

Also known as Internet banking or web banking, it involves accessing a bank's website through a computer browser. Customers can access practically all of the services typically provided by a local branch, such as deposits, transfers, and bill payments.

What is Mobile Banking?

Mobile banking is the act of conducting financial transactions using a mobile device.

Before apps became the modern standard for mobile banking, some banks provided SMS-based mobile banking, which allowed customers to conduct transactions by sending texts to the SMS banking line.

What is Digital Banking?

Digital banking refers to transactions that operate exclusively online.

Digital banks provide the same banking services as traditional banks. As a result, there are no actual bank branches, and all of your standard banking services are only accessible through a smartphone or other smart device.

Top Online and Mobile Banking Apps in the Philippines

In this section, we will look at some of the leading mobile and online banking apps in the country that are offering a range of features and services to their customers.

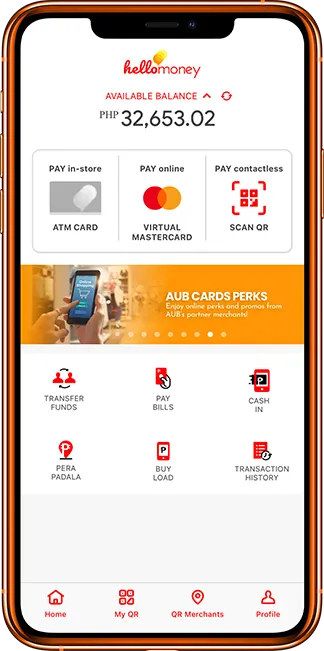

AUB Online Banking

In the AUB mobile app, clients can efficiently manage your reward points and air miles, exchange them for rewards, and use them to get free travel.

The existing AUB online banking web service serves as the foundation for the AUB Mobile App. It is designed to provide AUB clients with a robust, quick, and efficient mobile user experience.

AUB Savings Account | |

Minimum Initial Deposit | N/A |

Minimum Maintaining Balance | Php 5,000 |

Annual Interest Rates | 0.10% |

Below Maintaining Balance Monthly Fee | Php 250 |

Online Features |

|

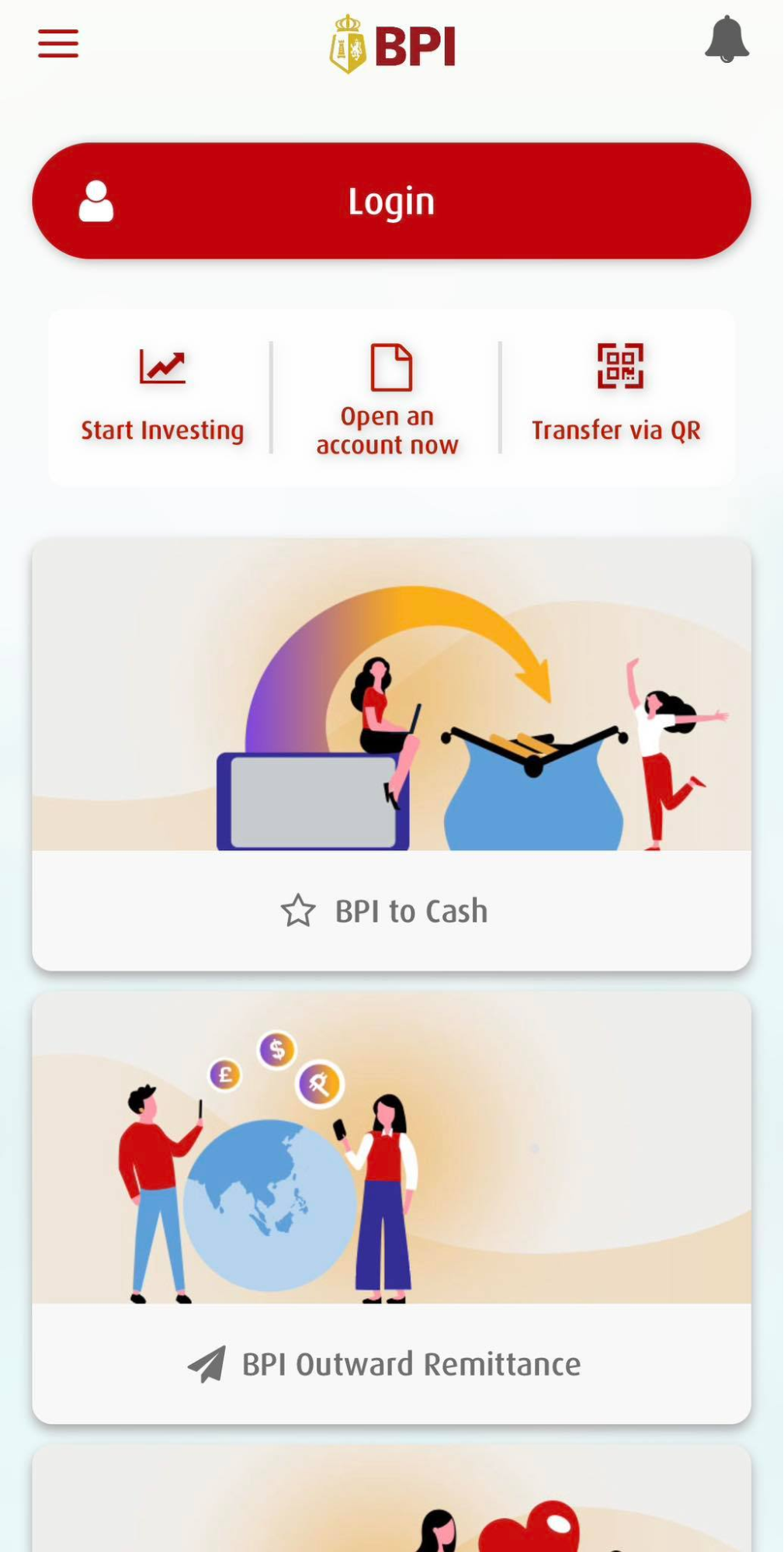

BPI Mobile and BPI Online

Bank of the Philippine Islands (BPI) is the first bank in Southeast Asia and the Philippines.

The BPI Online app and website had a significant update in 2019, and thanks to the better user interface and online security, BPI Online is now among the best mobile banking apps available.

BPI Regular Savings Account | |

Minimum Initial Deposit | Php 3,000 |

Minimum Maintaining Balance | Php 3,000 |

Annual Interest Rates | 0.0625% |

Below Maintaining Balance Monthly Fee | Php 300 |

Online Features |

|

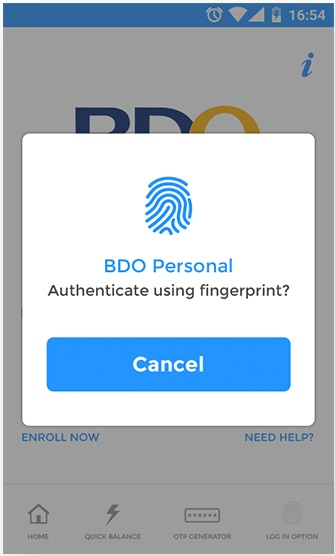

BDO Digital Banking

BDO is the biggest bank in the Philippines, owned by the SM Group which is among the most powerful corporations in the country.

The BDO Digital Banking app was recently updated and improved to create the BDO Online app, which is intended for simple and secure mobile banking.

BDO Peso Savings Account | |

Minimum Initial Deposit | Php 2,000 |

Minimum Maintaining Balance | Php 2,000 |

Annual Interest Rates | 0.0625% |

Below Maintaining Balance Monthly Fee | Php 300.00 |

Online Features |

|

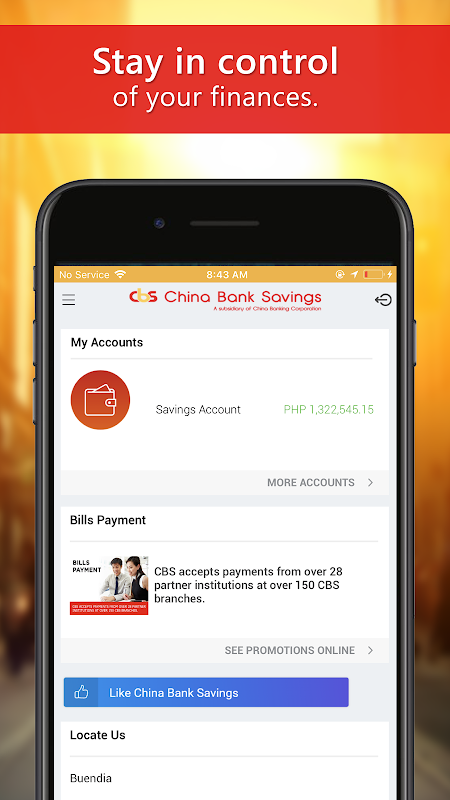

China Bank Online

China Bank’s online and mobile banking services includes a long list of features in addition to its remittance feature and innovative platform for applying for home and car loans.

China Bank Easi-Save ATM Savings Account | |

Minimum Initial Deposit | Php 500 |

Minimum Maintaining Balance | Php 500 |

Annual Interest Rates | 0.125% |

Below Maintaining Balance Monthly Fee | Php 300.00 |

Online Features |

|

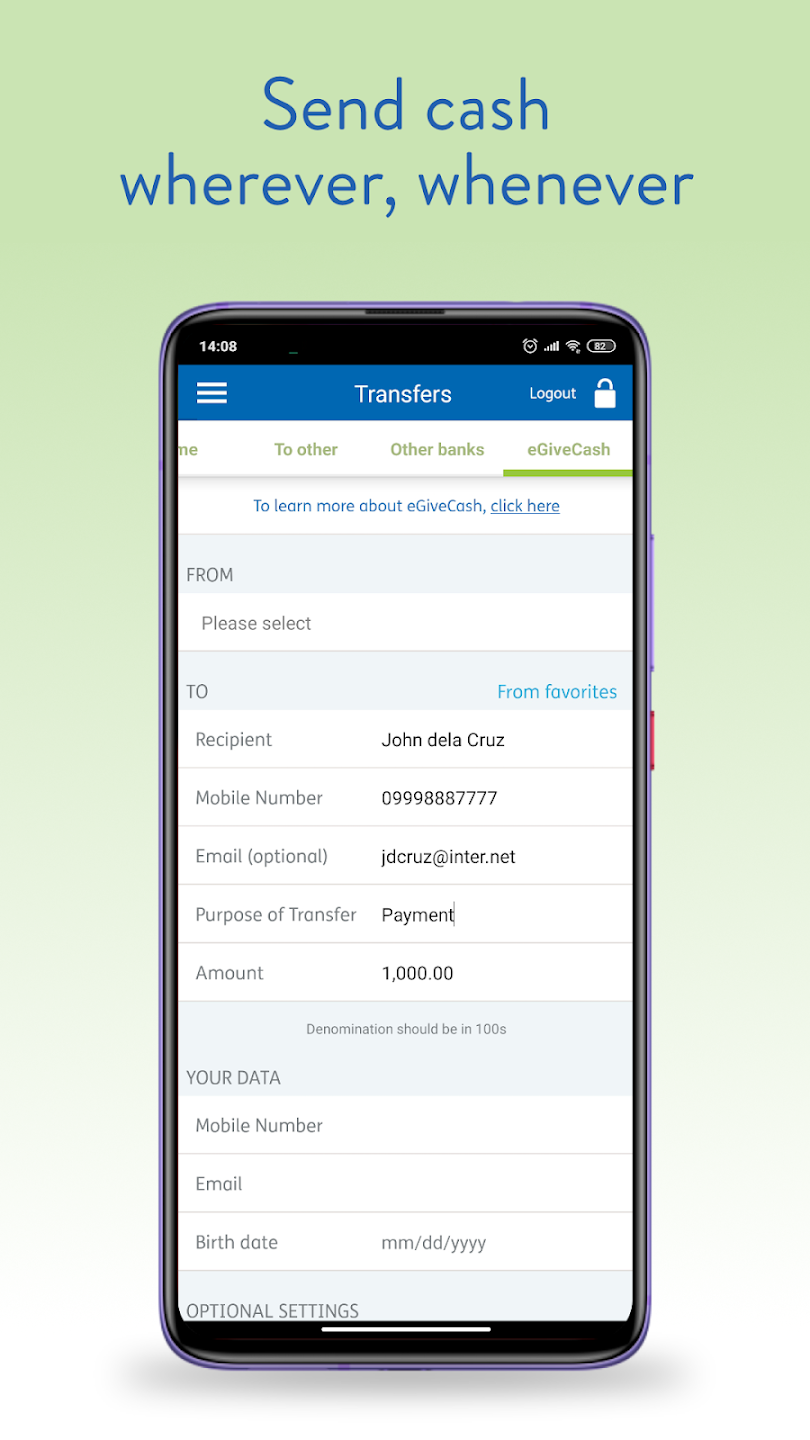

EastWest Online and Mobile

Customers of EastWest can benefit from the basic banking capabilities offered by the EastWest Mobile app. Customers can access more features by using the desktop-based EastWest Online service.

EastWest Savings Account | |

Minimum Initial Deposit | Php 2,000 |

Minimum Maintaining Balance | Php 2,000 |

Annual Interest Rate | 0.125% |

Below Maintaining Balance Monthly Fee | Php 500.00 |

Online Features |

|

Land Bank Mobile Banking App

Land Bank is the largest official lender in the provinces and the financial arm of the Philippine government.

The user-friendly layout of the LandBank app and its secure features provide users peace of mind. Clients can also receive real-time notifications from Landbank Mobile regarding forex and UITF rates.

LANDBANK ATM Savings Account | |

Minimum Initial Deposit | Php 500 |

Minimum Maintaining Balance | Php 500 |

Annual Interest Rate | 0.05% |

Below Maintaining Balance Monthly Fee | Php 200 |

Online Features |

|

Metrobank Mobile Banking

Metrobank is also one of the biggest banks in the Philippines that provides a wide variety of banking services.

In addition to the standard banking features, the Metrobank mobile app provides an in-app home and car loan calculator. Clients can get the most recent foreign currency rates, financial market news, and banking news from the Metrobank app.

Metrobank Regular Savings Account | |

Minimum Initial Deposit | Php 2,000 |

Minimum Maintaining Balance | Php 2,000 |

Annual Interest Rates | 0.0625% |

Below Maintaining Balance Monthly Fee | Php 200 |

Online Features |

|

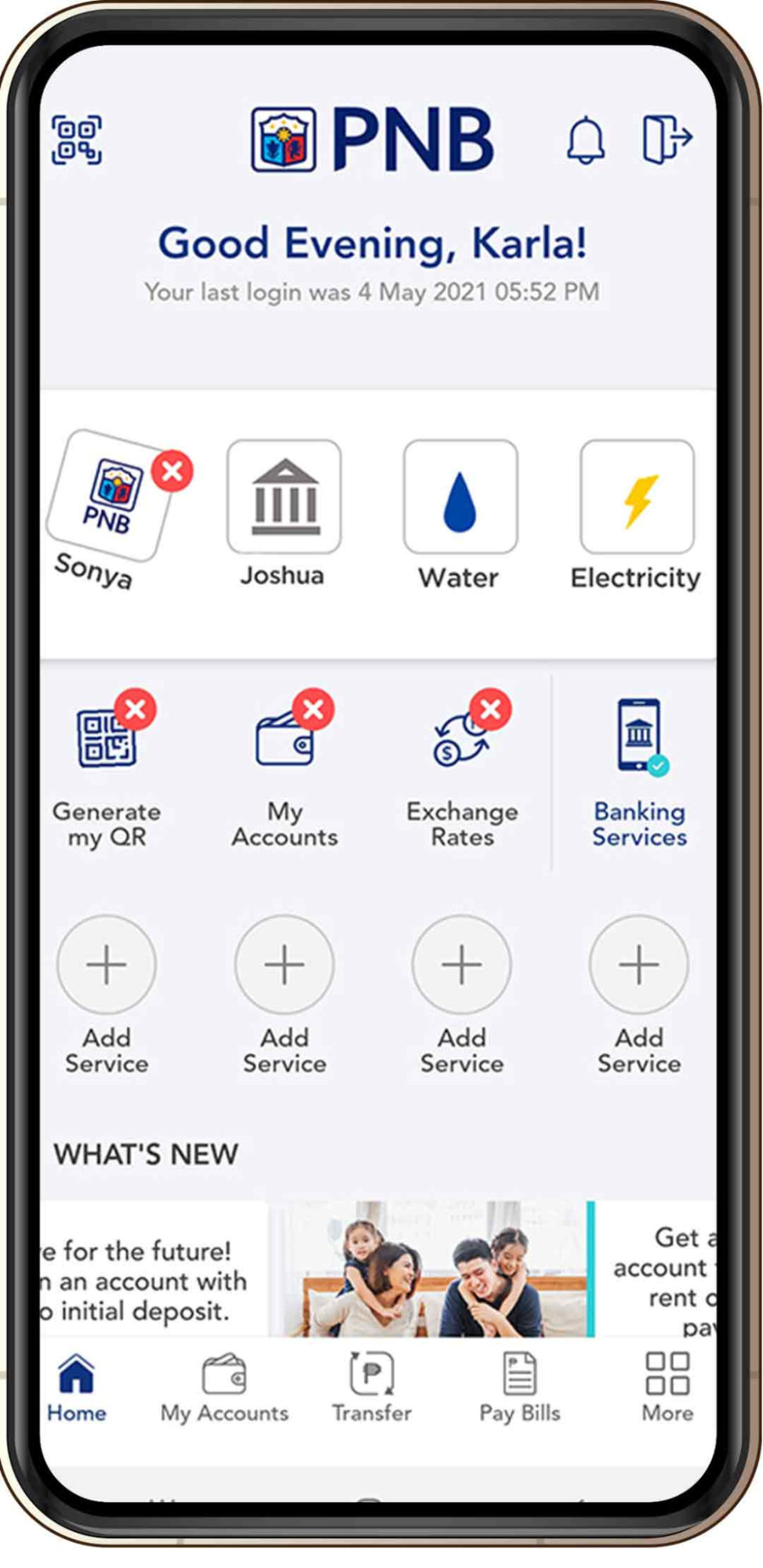

PNB Internet and Mobile Banking

Customers can consider opening an account with PNB if they want a solid desktop and mobile banking platform. The banking functions on PNB Internet and Mobile are efficient and simple to use.

For instance, customers can manage their credit and debit cards, check their UITF portfolio, and send money from anywhere in the country using the PNB Mobile app.

PNB Savings Account | |

Minimum Initial Deposit | Php 3,000 |

Minimum Maintaining Balance | Php 3,000.00 |

Annual Interest Rates | 0.10% |

Below Maintaining Balance Monthly Fee | Php 350.00 |

Online Features |

|

PSBank Mobile

PSBank significantly updated its mobile app, adding new efficient and secure features.

Check deposits, an in-app OTP generator, the option to lock and unlock your cards, and real-time account monitoring are just a few of the features that PSBank Mobile offers. Customers can also use the app to enable cardless ATM withdrawal.

PSBank Savings Account | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 2,000 |

Annual Interest Rates | 0.10% |

Below Maintaining Balance Monthly Fee | Php 500 |

Online Features |

|

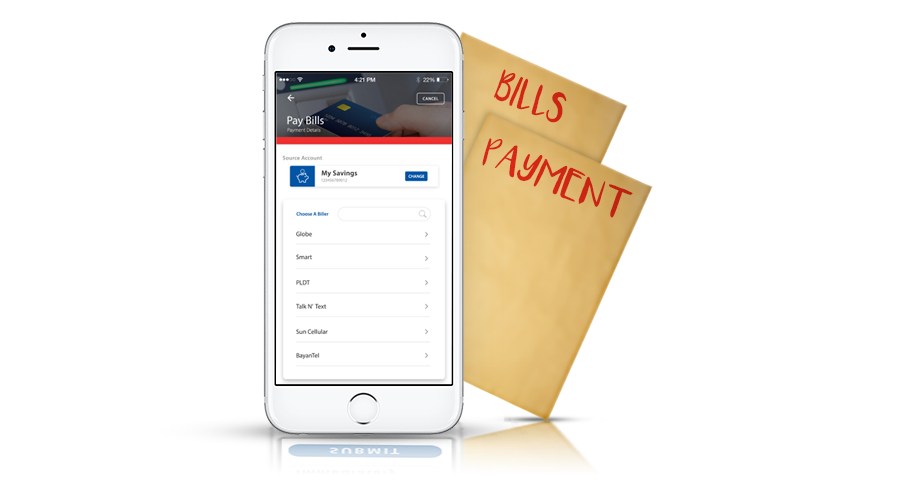

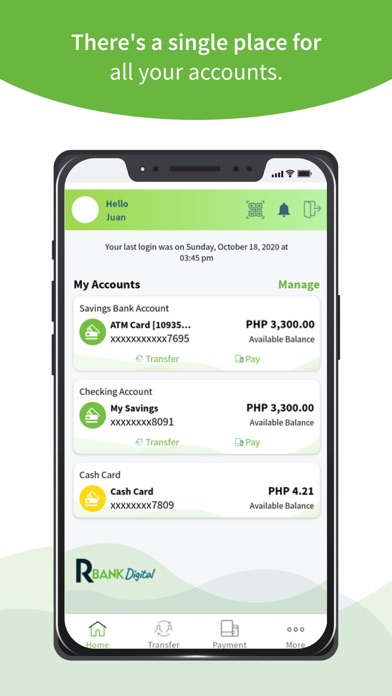

RBank Digital

RBank, also known as Robinsons Bank, offers the benefits of online banking.

In addition to their other online banking capabilities, RBank Digital allows customers to easily pay their bills, monitor their finances, and transfer money online.

RBank Savings Account | |

Minimum Initial Deposit | Php 2,000 |

Minimum Maintaining Balance | Php 2,000 |

Annual Interest Rates | 0.125% |

Below Maintaining Balance Monthly Fee | Php 500.00 |

Online Features |

|

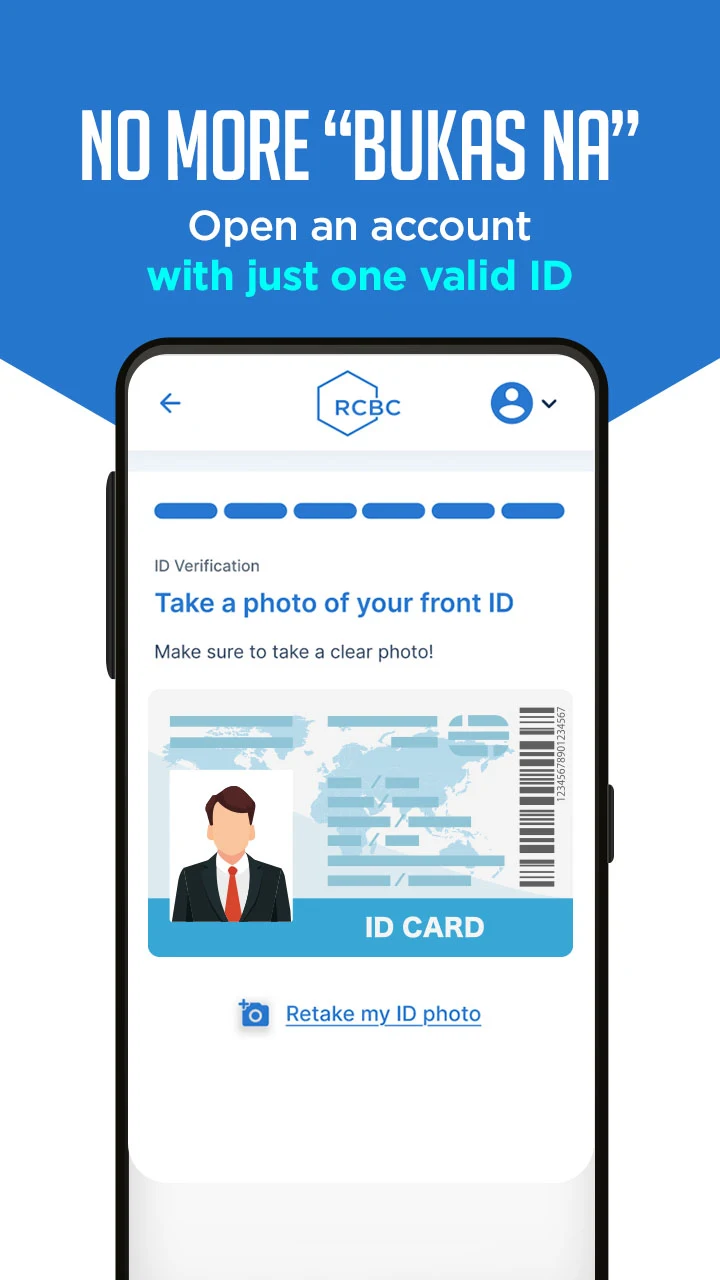

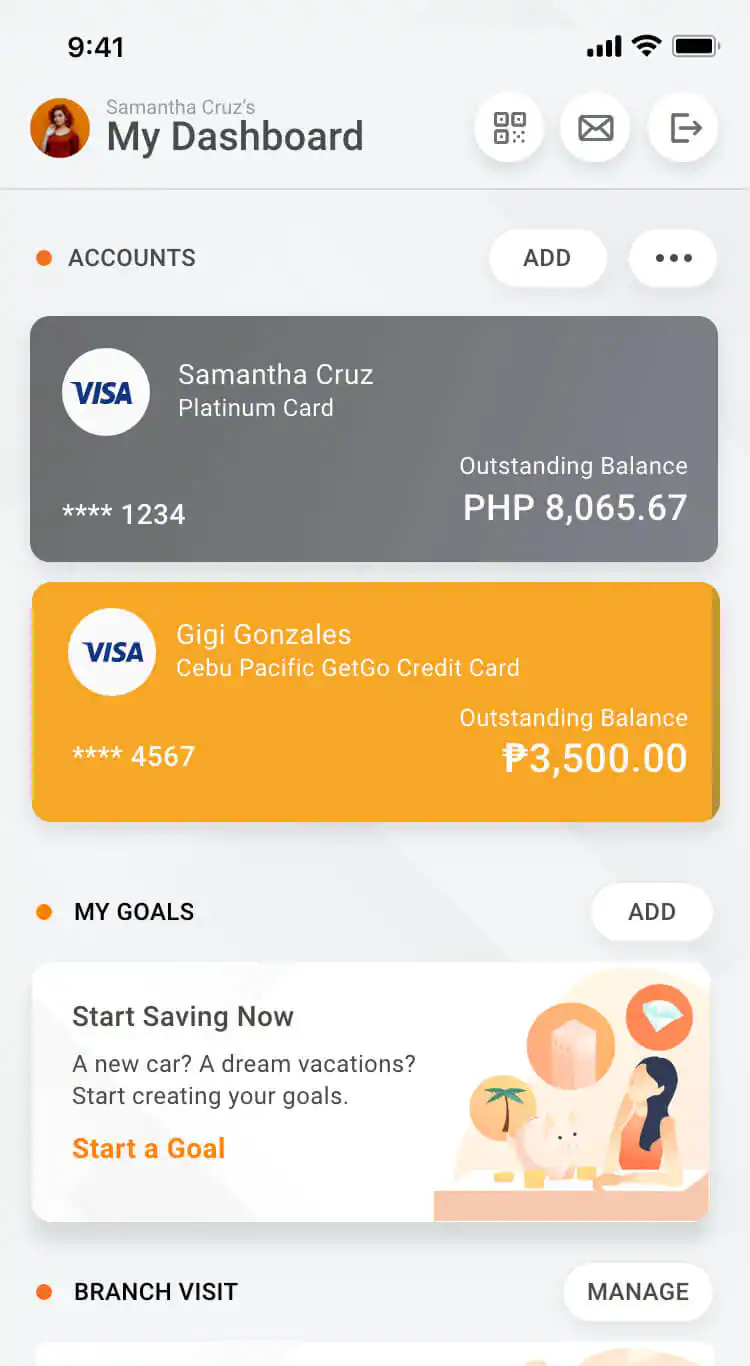

RCBC Digital

Numerous cutting-edge financial services are available on the RCBC Digital app. With the Convert to Installment function, customers can use an installment plan for their purchases. It also offers a QR generator for fund transfers and an in-app analyzer that can track current expenses.

RCBC Savings Account | |

Minimum Initial Deposit | Php 0 – Php 25,000 |

Minimum Maintaining Balance | Php 0 – Php 25,000 |

Annual Interest Rates | 0.15% – 4.00% |

Below Maintaining Balance Monthly Fee | Php 500.00 |

Online Features |

|

Security Bank Online

The robust mobile app from Security Bank Online enables users to open the app using a fingerprint or facial ID. The fast user interface and free service of the app make fund transfers easy as well.

Security Bank Savings Account | |

Minimum Initial Deposit | Php 100 – Php 10,000 |

Minimum Maintaining Balance | Php 500 – Php 25,000 |

Annual Interest Rates | 0.10% – 1.20% |

Below Maintaining Balance Monthly Fee | Php 300.00 |

Online Features |

|

UnionBank Online

Numerous accolades have been given to UnionBank for being a pioneer in online banking in the country. When it comes to digital banking, UnionBank is known for being innovative.

Its mobile banking app is superior to that of its competitors because it was the first bank in the Philippines to open a fully digital branch.

UnionBank Savings Account | |

Minimum Opening Deposit | Php 10,000 |

Minimum Maintaining Balance | Php 10,000 |

Annual Interest Rate | 0.10% |

Below Maintaining Balance Monthly Fee | Php 1,000 |

Online Features |

|

Best Online and Mobile Banking Apps Comparison

Let's now review the data from above and compare their key features. We have put together this comparison of the best online and mobile banking apps, so you can make an informed decision about which one will meet your needs.

Online Features | Online and mobile banking services that offer the feature | Online and mobile banking services that don’t offer the feature |

Transfers and online bill payments | All banks | None |

Notifications and warnings | All banks | None |

Online account opening | All banks | None |

ATM and Branch Locator | All banks | None |

Biometric authentication | BPI, BDO, Land Bank, Metrobank, PNB, PSBank, RCBC, Security Bank, Unionbank | AUB, ChinaBank, EastWest, RBank |

Card Control | BPI, BDO, EastWest, Land Bank, PSBank, RBank, RCBC, Security Bank, UnionBank | AUB, China Bank, Metrobank, PNB |

Cardless ATM withdrawals | BDO, China Bank, Landbank, Metrobank, PNB, PSBank, RCBC, Security Bank, UnionBank | BPI, EastWest, RBank |

Chatbot support | BPI, BDO, EastWest, Landbank, Metrobank, PNB, RCBC, Security Bank, UnionBank | ChinaBank, PSBank, RBank |

Top 11 Digital Banks in the Philippines

Digital banks in the Philippines are becoming increasingly popular as more people are turning to digital banking services for convenience and safety.

With a wide range of features and services, these digital banks are providing Filipinos with a convenient way to manage their finances.

In this section, we will discuss the top 11 digital banks in the Philippines and their features that make them stand out from the rest.

CIMB Bank

Southeast Asia is home to more than 1,000 branches of Malaysia's CIMB Bank. In January 2019, it began operating in the Philippines, positioning itself as an all digital bank.

CIMB Bank | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | 2.5% – 4% |

Physical Debit Card | Yes |

Other key features |

|

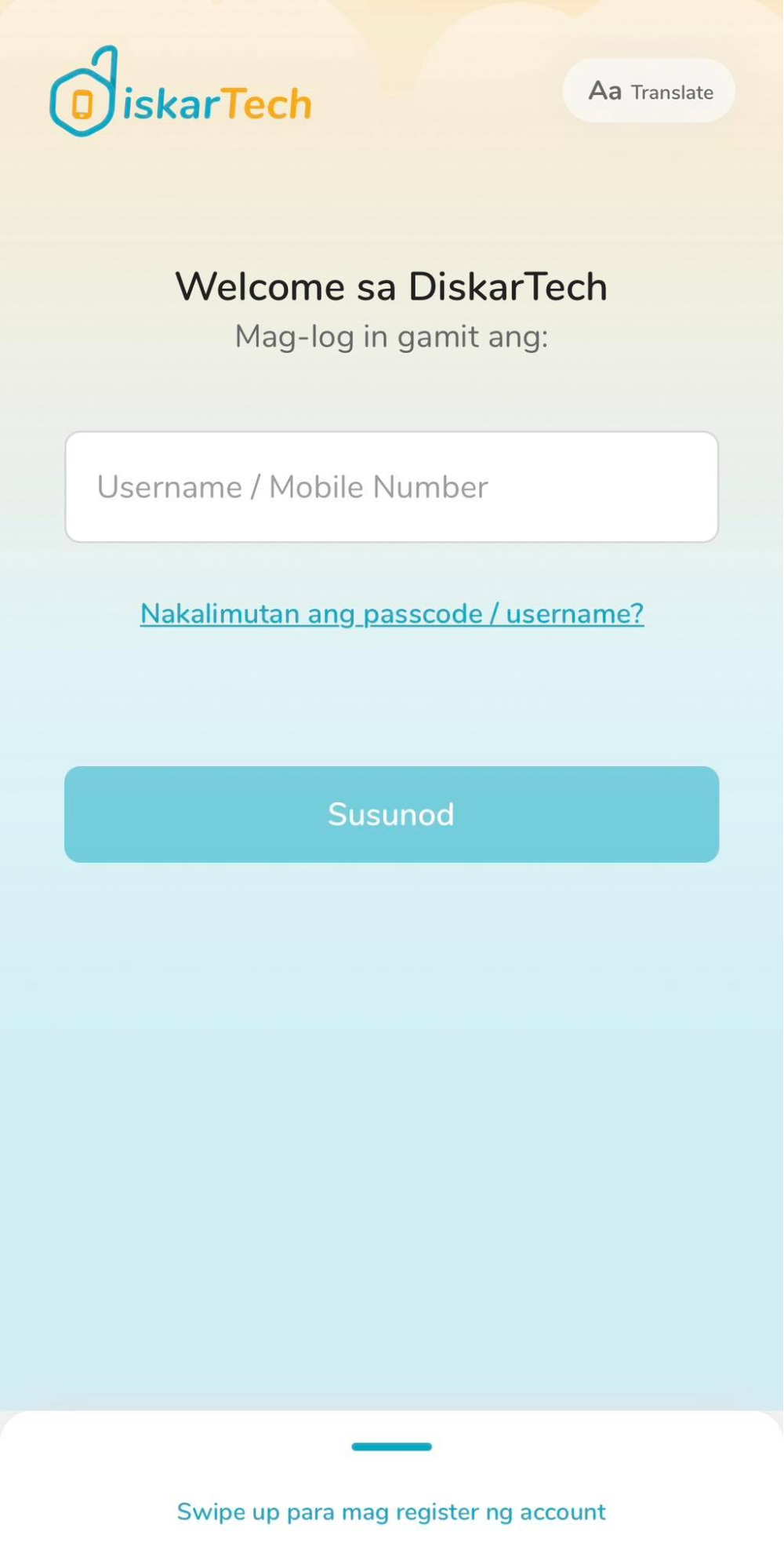

DiskarTech

This app, which is run by Rizal Commercial Banking Association (RCBC), offers basic functions including opening a savings account, loading your phones, and making deposits and withdrawals through partner channels.

DiskarTech | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | 3.25% |

Physical Debit Card | No |

Other key features |

|

GoTyme Bank

GoTyme is a partnership between Tyme, a multi-country digital banking group headquartered in Singapore, and the Gokongwei Group of companies. GoTyme Bank combines the convenience of an instant account opening with a customized debit card issued through kiosks across the entire country of the Philippines.

GoTyme | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | 3% |

Physical Debit Card | Yes (FREE) |

Other key features |

|

Komo by EastWest

EastWest Bank powers the virtual banking service known as Komo. It gives users a debit card that can be used for free fund transfers, withdrawals, and online bill payments through the Komo mobile app.

Komo by EastWest | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | 3% |

Physical Debit Card | Yes (FREE) |

Other key features |

|

Maya Bank

Maya Bank, formerly PayMaya, is a feature-rich money app targeted for Filipino consumers. Users may save, grow, and invest their money with the help of Maya, which merges a secure wallet with a cutting-edge banking experience.

Maya Bank | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | 4.5% – 6% |

Physical Debit Card | Yes |

Other key features |

|

NetBank

The first platform in Southeast Asia offering banking as a service is Netbank. In order for Filipino Fintechs to expand quickly, cut expenses, and speed up financial inclusion and innovation, it offers banking services on a totally white-labeled model.

NetBank | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 1.00 |

Annual Interest Rates | Up to 7% |

Physical Debit Card | Yes |

Other key features |

|

Overseas Filipino Bank (OF Bank)

OFBank, a digital-only bank that is a wholly-owned subsidiary of Land Bank, enables its customers to conduct financial transactions anywhere in the world. This feature is exactly why it’s intended for OFWs and their families.

Overseas Filipino Bank | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | 0.05% |

Physical Debit Card | Yes |

Other key features |

|

SeaBank

The SeaBank PH mobile banking app was created to accommodate all users' daily financial demands. It is a division of Sea Limited's digital finance services unit, which also owns Shopee.

Sea Bank | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | Up to 5% |

Physical Debit Card | No |

Other key features |

|

Tonik Bank

Tonik focuses on the sizable unbanked population in the country. This Singapore-based neo bank offers quick, simple, secure transactions for consumer financial products, deposits, loans, savings accounts, and payments. It is a 100% digital platform.

Tonik Bank | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | 1.00% – 6.00% |

Physical Debit Card | Yes |

Other key features |

|

UnionDigital

UnionDigital, a division of UnionBank, is a fully digital bank available to all Filipinos. UnionDigital's mission is to provide everyone with access to safe and secure virtual assets and digital banking.

UnionDigital | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | 1.00% – 6.00% |

Physical Debit Card | Yes |

Other key features |

|

UNO Digital Bank

UNO Digital Bank is among the six digital banks recognized by BSP. UNOBank is prepared to compete in the Philippines' digital banking market with its artificial intelligence-powered platform.

UnionDigital | |

Minimum Initial Deposit | Php 0 |

Minimum Maintaining Balance | Php 0 |

Annual Interest Rates | Up to 4.25% |

Physical Debit Card | Yes |

Other key features |

|

Choosing the Best Digital, Mobile, or Online Bank

Finding the right digital, mobile or online bank for your needs can be a daunting task. With so many options available, it is important to consider all factors before making your decision.

Remember to look at the features and services offered by each bank and compare them to determine which one best suits your needs. These features range from fees and interest rates to customer service and security measures.

Research all of the options available, so you can make an informed decision that will provide you with the best banking experience possible.

FAQ

What is the best digital bank in the Philippines?

Choosing the best digital banks largely depends on your needs and goals.

For instance, if you aim to use the digital bank account for savings, then your best option is Maya which offers up to 6% of annual interest rate. But if you are looking for a digital bank that’s helpful for foreign remittances, then OFBank should be your top choice.

Is Gcash a digital bank?

No. GCash is a mobile wallet rather than a digital bank. With GCash, customers can make purchases of goods and services, typically through a smartphone app.

It differs from a digital bank, which operates mostly online and lets customers do the majority of their banking operations there.

How many digital banks are licensed in the Philippines?

There are currently six digital banks licensed by the Bangko Sentral ng Pilipinas (BSP). These digital banks are UnionDigital, GoTyme, Tonik, Maya Bank, OFBank, and UNObank.

When was digital banking introduced in the Philippines?

Digital banking was first officially recognized by the Bangko Sentral ng Pilipinas (BSP) in 2020.

That year, BSP approved digital banks as a new official category of banks. But in 2017, Union Bank of the Philippines was the first to open the nation's first all digital branch.

PROMO

FREE Web Hosting

for Your Website