What You Need to Know When Getting and Activating GCash Mastercard

The GCash Mastercard is a valuable addition to your virtual and physical wallets, making it a helpful tool. To obtain this card, you will need to have a GCash account. You can apply for one through the GCash application, available for download on both the App Store and Google Play.

Once you have a GCash account, you can apply for a Mastercard through the app by following a few simple steps. It's a convenient way to make payments and access cash. It's essential to understand how to get a GCash card.

This guide provides comprehensive information on purchasing, activating, and utilizing the GCash card.

Can you explain what a GCash Mastercard is?

This is a prepaid card linked to your GCash account, which allows you to make payments and withdraw cash at merchants and ATMs that accept Mastercard. It can be used in-store and online and worldwide at any merchant that accepts Mastercard.

Here are its salient features:

- It comes with an EMV chip which means it has a small microprocessor embedded in it that provides an extra layer of security when making transactions.

- It also has a 16-digit number, like a traditional credit or debit card, and a 3-digit Card Verification Value (CVV) code on the back of the card, an added security measure for online transactions.

- The card doesn't require a maintained balance, as it is a prepaid card. You can load it with funds and use it as you see fit until the balance is finished. It eliminates the need to maintain a certain balance in your account, as you only spend what you have loaded into the card.

- The card offers a protection program for its customers. This covers unsecured transactions. This program protects cardholders in case of unauthorized transactions made with their Mastercard.

- The card has a withdrawal limit but is not public and varies depending on the user. It is advisable to check the limit from the application or customer support.

Other features of GCash Mastercard:

- Loading funds: You can load funds into your GCash account and Mastercard using various methods such as bank transfers, debit or credit cards, and 7-Eleven outlets.

- Viewing transaction history: You can view your recent transactions and transaction history in the GCash app, allowing you to keep track of your spending.

- Checking balance: You can check your GCash account and GCash Mastercard balance in the GCash app, so you always know how much funds you have available.

- Locking and unlocking card: You can lock or unlock your GCash Mastercard in the GCash app if you misplace it or need to prevent unauthorized transactions.

- Disabling card: You can disable your GCash Mastercard in the GCash app in case of loss or theft, to prevent unauthorized transactions.

- Generating a new card: You can generate a new card if you need to replace a lost or stolen card.

- Card activation: You can activate your GCash Mastercard in the GCash app once it arrives at your registered address.

These self-service features make it easy to manage your GCash account and GCash Mastercard on your own without needing to contact customer support.

How can you link your GCash Mastercard to your account?

Linking your card to your GCash account is a simple process:

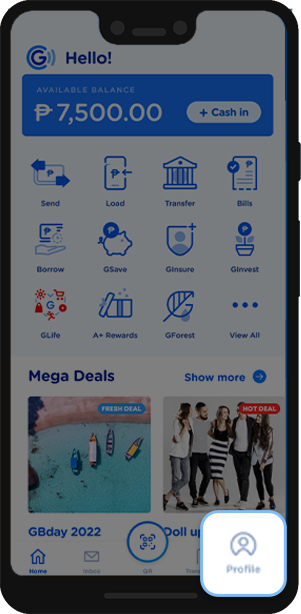

- Open the application on your device.

- Tap the "Profile" button in the screen's lower right corner.

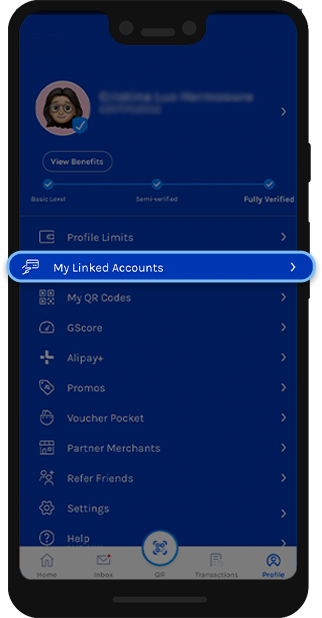

- Select "My Linked Accounts" from the menu options.

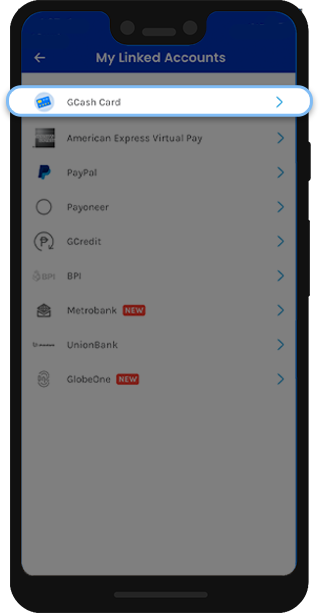

- Choose GCash card and click “Link Physical Card.”

- You will be redirected to a screen where you’re account will require verification. Allow the app to send the unique 6-digit code to your GCash number.

- After inputting the code, click done. Follow the instructions provided on the screen to link your GCash Mastercard. This may include providing your card details, such as the last four digits of your card and the 12-digit account number on the back of the card.

- Choose a 6-digit PIN and click next.

- You have now successfully added your card to your account.

Once your card is activated, you can make purchases and withdraw cash from ATMs.

Note: If you already have a GCash Mastercard, please make sure that it is activated and that you have the correct details of your card.

Setting and Resetting a Card PIN

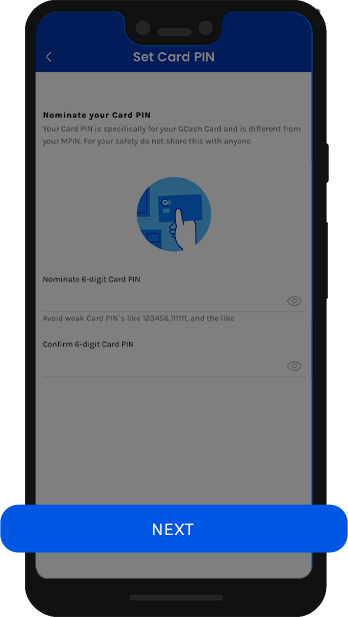

A PIN is necessary for ATM withdrawals and point-of-sale payments. Please remember that the 6-digit GCash PIN is separate from the 4-digit one used to log into your GCash account on your mobile device.

Remember that 6-digit GCash Mastercard PIN is separate from the 4-digit MPIN used to log into your GCash account on your mobile device.

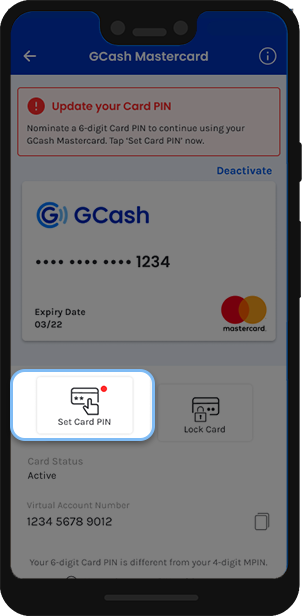

Instructions for Setting A 6-Digit PIN

- To access your profile, access your GCash app and select the 'Profile' option.

- From the 'Profile' page, choose 'Linked Accounts,' then select 'GCash Card.'

- Pick the account linked to your card, then tap on 'Set Card PIN.'

- Enter your desired 6-digit PIN and then re-enter it on the next line for confirmation.

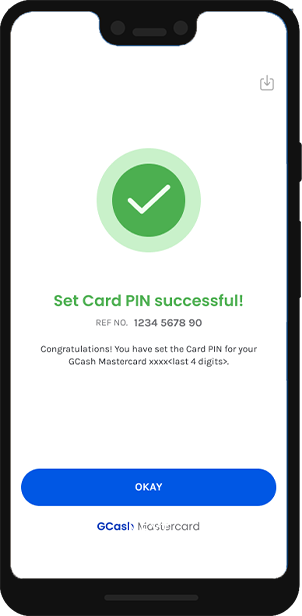

- You will receive a notification that your 6-digit MPIN for your GCash Mastercard has been successfully set.

To reset your 6-digit PIN, please follow these steps:

- Open your GCash app and select 'Profile.'

- Tap on 'My Linked Accounts' then 'GCash Card.'

- Select the account linked to your GCash Mastercard and tap 'Reset Card PIN.'

- Enter the 6-digit security or authentication code before you press 'Submit.'

- Input your new desired 6-digit PIN in both fields for confirmation.

- You will receive a notification that your 6-digit PIN for your GCash Mastercard has been successfully changed.

Associated Fees

The cost and fees associated with using a GCash Mastercard are as follows:

- GCash Mastercard cost: ₱150 (an additional ₱65 delivery fee applies for online applications)

- Withdrawal fee for ATMs: Fees vary based on the bank servicing the said ATM

- Balance inquiry for ATMS: ₱3 per transaction

Uses and Advantages of a GCash Mastercard

A GCash Mastercard offers additional functionality to your GCash account. While the GCash app alone can handle most financial transactions, having a GCash Mastercard expands the capabilities of your mobile wallet.

Accessing Your GCash Funds through Withdrawal

Your card allows you to withdraw your card balance via various BancNet ATMs in the Philippines or any affiliated ATMs worldwide. This can be useful in situations where you need physical cash for emergencies.

Although GCash offers other cash-out options, such as through partners like Puregold and SM, these may not be available 24/7. This card also provides you with the convenience of being able to access your funds at any time through ATMs that typically operate 24/7.

Making Online Payments

With the GCash Mastercard, you can easily make payments on online platforms that accept Mastercard payments. This can include e-commerce websites, booking sites, subscription services, and more locally and internationally.

This can be a convenient option for those who do not have access to a traditional credit or debit card and allows for easy online transactions on popular sites such as Shopee, Lazada, and Amazon, as well as monthly subscription services like Spotify and Netflix.

Pay for Purchases Made In-Store

With a GCash Mastercard, you can quickly pay for in-store purchases at any merchant that accepts Mastercard. This includes physical stores, supermarkets, gas stations, and many more.

Simply scan the said store’s QR code and input the amount of your purchase. This is a convenient alternative to carrying cash or using other payment methods, such as credit or debit cards. You can also present your GCash Mastercard at the POS terminal and make a payment.

Limitations of the GCash Mastercard

While a GCash Mastercard offers many advantages, it also has certain limitations. Some of these include:

Obtaining a GCash Mastercard is limited to verified users

If you have a basic GCash account, ensure that your account is verified before getting a Mastercard. This can be done by submitting the necessary documents and verifying your identity through the application.

GCash Mastercards don’t display the cardholder's name

You can simply reload this debit card that does not include the cardholder's name, making it difficult to verify ownership during in-store transactions.

Ordering a GCash Mastercard

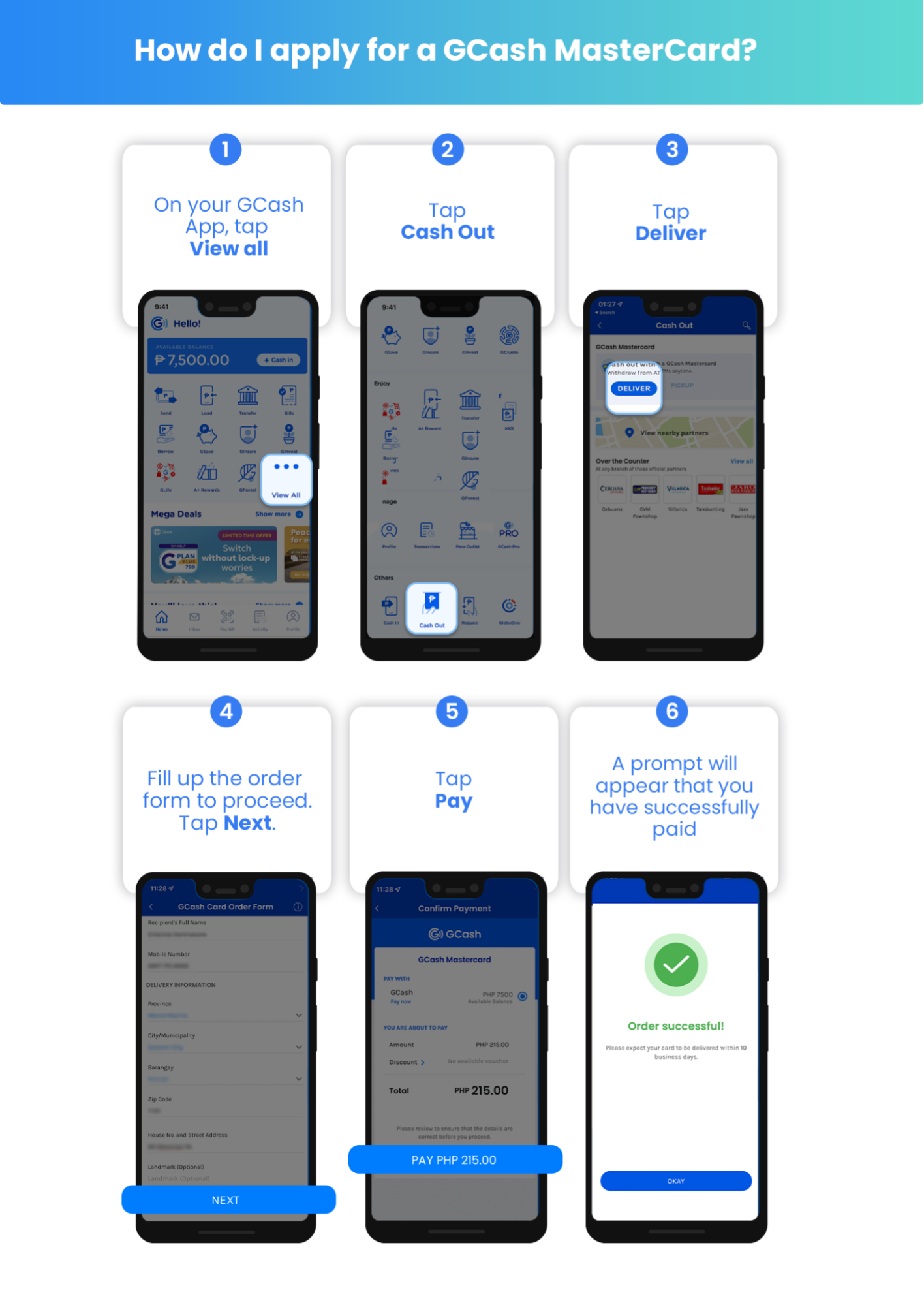

To obtain a card through the application, follow these steps:

- To log in to GCash, open the application and enter your MPIN.

- To access the Cash Out feature, click "View All," and then under "Others," select the Cash Out button.

- Go to the GCash Mastercard section and select the "Deliver" option.

- Go through the directions provided, scroll down, and look for the order form for a GCash Mastercard.

- Input the necessary information.

- Make sure to agree to all terms after reading them.

- Once you see the order ID, choose ‘pay 215.’

- A prompt will appear once you have paid successfully.

You’ll have to wait for ten business days before your card arrives. You will receive a text message confirming the transaction.

Activating a GCash Mastercard

Activate your card immediately upon receipt to take full advantage of its benefits. Connect your Mastercard to your electronic wallet account via the app or dialing *143#.

Activating through the application

To link your GCash Mastercard to your account:

- Open your GCash account.

- Choose the menu on the upper left corner of your home screen.

- Choose ‘My Linked Accounts’ and then ‘GCash Mastercard.’

- Choose the ‘Link Card’ option.

- Enter the 16-digit Mastercard number (found on the face of the card).

- Choose ‘Link Card’ again.

Activating via *143#

- On your phone, key in *143#.

- Pick 10 to pick GCash, and 3 for the GCash Card.

- After which, pick 1 to start activating your card.

- Key in your MPIN.

- Enter your Mastercard number (16 digits).

FAQ

What is the advantage of having a GCash Mastercard?

There are several advantages to having a GCash Mastercard. Some of the main benefits include:

- Convenience: The GCash Mastercard can be used to make purchases online and in-store anywhere Mastercard is accepted.

- Access to cash: With the GCash Mastercard, you can withdraw money from ATMs and over-the-counter at partner banks.

- Easy link to e-wallet: The GCash Mastercard can be easily linked to your GCash e-wallet account, allowing you to transfer funds between the two.

- Security: The GCash Mastercard provides an added layer of protection when making online transactions, as you don't need to provide personal information.

- Rewards and discounts: As a GCash Mastercard holder, you can enjoy exclusive discounts and rewards from GCash partners.

It's important to note that fees and limits may apply, and it's essential to review the terms and conditions before using the card.

What bank can I use, GCash Mastercard?

The GCash Mastercard is a virtual prepaid card issued by GCash, a mobile wallet and online payment platform in the Philippines. As a Mastercard, it can be used to make purchases online and in-store anywhere Mastercard is accepted.

This includes retailers, merchants, and service providers that accept Mastercard, both in-store and online. Additionally, you can use GCash Mastercard to withdraw cash from ATMs and over-the-counter at partner banks, which are typically banks in the Philippines.

Is GCash Mastercard debit or credit?

GCash Mastercard is a virtual prepaid card, meaning it is a debit card. With a debit card, the funds are taken directly from the cardholder's bank account or e-wallet, in this case, the GCash account.

In contrast, with a credit card, the card issuer lends the cardholder a certain amount of credit, and the cardholder is required to pay back the borrowed amount, plus interest, at a later date.

How do I put money on my GCash Mastercard?

There are several ways to put money on your GCash Mastercard:

- Through the GCash application: You can load money into your GCash account using various methods such as debit or credit card, bank transfer, and over-the-counter transactions at partner establishments. Once the funds are in your GCash account, you can transfer them to your GCash Mastercard.

- Over-the-counter transaction: You can add funds to your GCash account by going to any GCash partner outlets such as 7-Eleven, Cebuana Lhuillier, and SM Business Centers.

- Bank transfer: You can transfer funds from your bank account to your GCash account by providing the account number and bank name to your bank.

- Remittance: You can also receive money overseas via remittance centers such as Western Union, LBC, and Palawan Pawnshop.

It's important to note that fees may apply for some of the transactions, and it's essential to review the terms and conditions before using the card.

Takeaway

To get a GCash Mastercard, you must have a GCash account and a verified mobile number. You can apply for the card through the GCash application or website. Once you have received your card, you need to activate it and link it to your GCash account through the application or by dialing *143#.

Other frequently asked questions regarding GCash Mastercard may include information on fees, limits, and usage. It's important to review the terms and conditions before applying for and using the card.

PROMO

FREE Web Hosting

for Your Website